Mint is a free personal finance tool, originally launched by Intuit in 2006, that helps individuals and families manage their money smarter. By linking bank accounts, credit cards, loans, and investments, Mint provides a clear snapshot of your complete financial picture in one central platform—accessible both via web and mobile app.

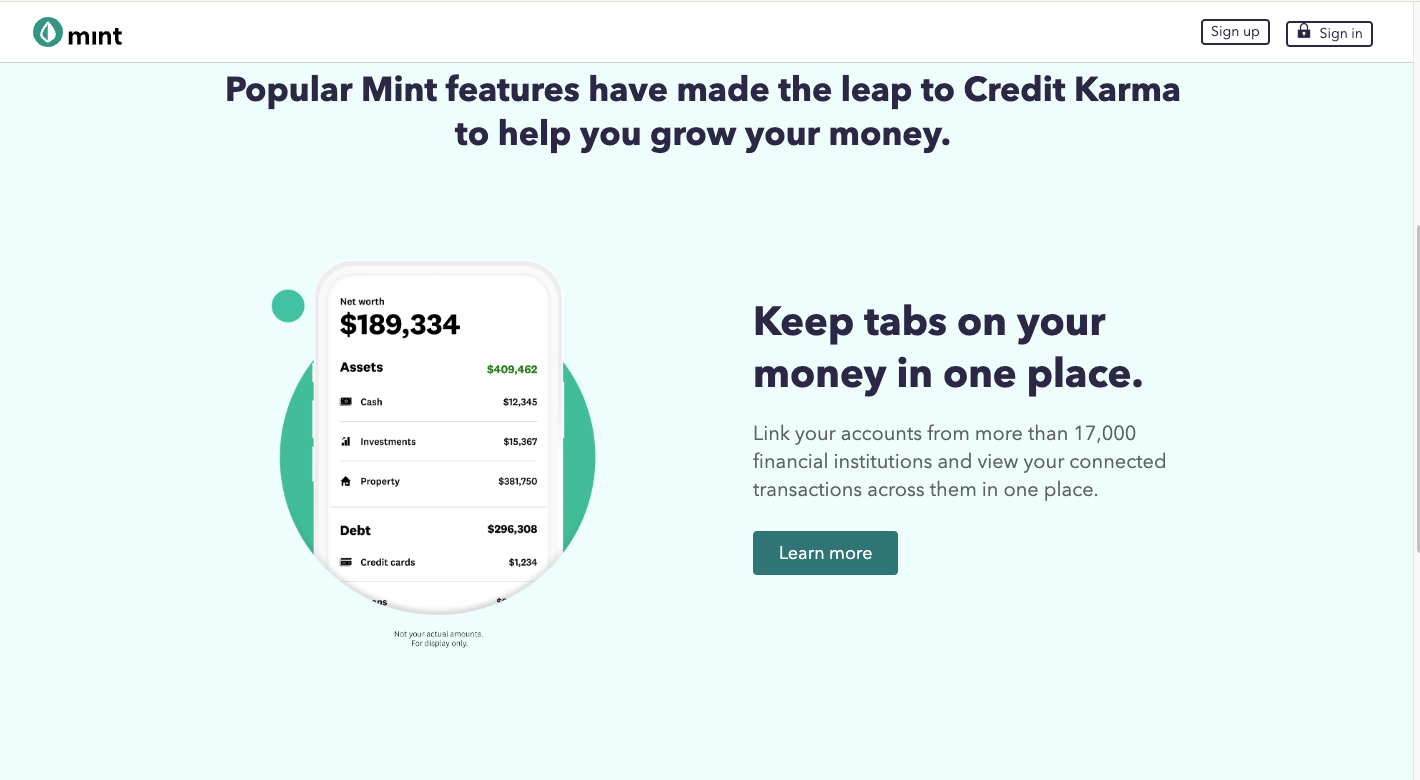

All of Mint’s core features are available at no cost. The app automatically categorizes transactions to help you see where your money is going, and it lets you create and track monthly budgets with clear visual summaries. You can also monitor your credit score for free, set up alerts for upcoming bills or exceeding budget limits, and use the net worth tool to track assets and debts over time. Mint also offers personalized money-saving tips and recommendations—like better credit card options or lower-interest refinancing—helping families spot ways to save or earn more.

For parents, Mint brings powerful benefits. It makes household finances transparent and manageable, reducing stress and surprises around spending. You can involve older children in budgeting by sharing spending categories or goals, helping them learn financial responsibility. Alerts and reminders mean no more missed payments or overdraft fees, giving peace of mind. And by tracking income, bills, and savings, families can set and work toward financial goals—such as college funds, vacations, or emergency funds—while building healthy money habits together.